Choosing the Right Payment Gateway UAE for Your eCommerce Venture

In the dynamic landscape of eCommerce, one of the critical aspects that can make or break your online business is the choice of a reliable payment gateway UAE. The United Arab Emirates (UAE) has witnessed a significant surge in eCommerce activities, making it essential for businesses to integrate secure and efficient payment solutions.

In this blog post, we will explore the best payment gateway UAE, helping you make an informed decision for your eCommerce website.

A Brief About Payment Gateways

Before delving into the specifics, it’s crucial to understand the role of payment gateways in the eCommerce ecosystem. A payment gateway is a technology that facilitates online transactions by securely transmitting payment information between the customer, the merchant, and the acquiring bank. Choosing the right payment gateway UAE is paramount for providing your customers a seamless and secure purchasing experience.

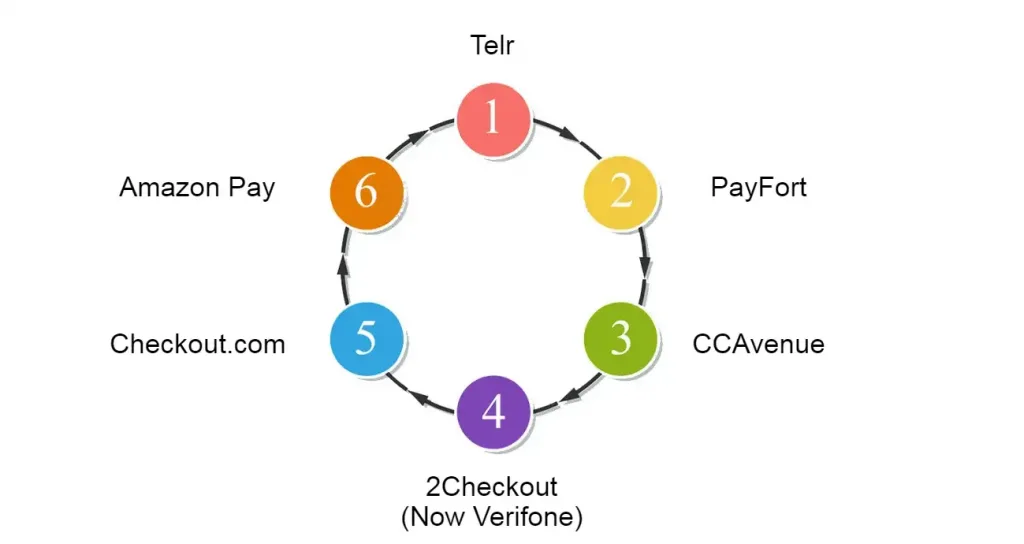

Top Payment Gateways UAE For Ecommerce

Telr

Telr is a popular payment gateway UAE, known for its simplicity and comprehensive features. In fact, it supports a variety of payment methods, including credit cards, debit cards, and digital wallets. Telr also offers features like fraud prevention and multi-currency support, making it an attractive choice for businesses with international customers.

PayFort

Acquired by Amazon, PayFort is a leading payment gateway UAE in the region. It supports various payment options, including credit cards, direct debit, and even cash on delivery. Moreover, PayFort is renowned for its robust security features and seamless integration capabilities, making it a favorite among eCommerce businesses in the UAE.

CCAvenue

While CCAvenue is widely used in India, it has expanded its services to the UAE and other countries. With a user-friendly interface and support for multiple currencies, CCAvenue is an excellent choice for businesses looking to cater to a diverse customer base. The platform also provides advanced analytics to help merchants track and analyze their transactions.

2Checkout (Now Verifone)

Verifone, formerly known as 2Checkout, is a global payment service provider catering to UAE businesses. It allows a wide range of payment methods and provides a secure environment for online transactions. Verifone also offers recurring billing options, making it suitable for businesses with subscription-based models.

Checkout.com

Known for its advanced technology and customizable solutions, Checkout.com is gaining popularity in the payment gateway UAE eCommerce scene. Checkout.com supports various payment methods and provides real-time analytics to help businesses make data-driven decisions. In addition, the platform’s flexibility and scalability make it suitable for businesses of all sizes.

Amazon Pay

Amazon Pay allows customers to use their Amazon account to purchase on other websites. With the familiarity and trust associated with the Amazon brand, this payment gateway can enhance the user experience and increase conversion rates. It offers a seamless checkout process, allowing customers to complete transactions quickly and securely.

Factors to Consider When Choosing a Payment Gateway

Security

Security should be a top priority when selecting a payment gateway. Look for options that comply with industry standards and offer features like encryption and fraud prevention to ensure the safety of your customers’ data.

Integration and Compatibility

Choose a payment gateway that seamlessly integrates with your eCommerce platform. Consider factors such as ease of integration, developer-friendly APIs, and compatibility with popular eCommerce platforms like Shopify, WooCommerce, or Magento.

Supported Payment Methods

Different customers prefer different payment methods. Ensure that the payment gateway you choose supports a variety of options, including credit/debit cards, digital wallets, and other local payment methods prevalent in the UAE.

Transaction Fees

Be aware of the transaction fees associated with each payment gateway. Compare the costs and choose a provider that aligns with your budget and business model. Some gateways may have a fixed fee per transaction, while others may charge a percentage of the transaction amount.

Customer Support

Reliable customer support is crucial, especially when dealing with financial transactions. Choose a payment gateway provider that offers responsive and helpful customer support to address any issues promptly.

How To Integrate Payment Gateway?

Integrating a payment gateway into your eCommerce website is a crucial step in enabling online transactions. However, the process may vary slightly depending on the payment gateway provider and your eCommerce platform. Below is a general guide outlining the steps involved in integrating a payment gateway:

Choose a Payment Gateway

Select a payment gateway that suits your business needs and is compatible with your eCommerce platform. Consider factors such as supported payment methods, security features, transaction fees, and ease of integration.

Set Up an Account with the Payment Gateway Provider

Before integration, you need to create an account with the chosen payment gateway provider. This typically involves providing business information, bank account details, and agreement to the terms of service.

Gather API Credentials

Once your account is set up, the payment gateway provider will provide you with API credentials. These credentials, including API keys, merchant IDs, and secret keys, are essential for securely connecting your website to the payment gateway.

Choose Integration Method

Payment gateways generally offer different integration methods, such as hosted payment pages, direct API integration, or SDKs (Software Development Kits). Choose the method that aligns with your technical expertise and business requirements.

Integrate Payment Gateway with Your Website

Direct API Integration

Backend Development

Your developers will need to integrate the payment gateway’s API into your website’s backend. This involves coding to handle payment requests, responses, and error handling.

Security Measures

Implement security measures such as data encryption (SSL) to ensure the secure transmission of sensitive information.

Hosted Payment Pages

Redirect Users

Users are redirected to a secure payment page hosted by the payment gateway provider.

Customization

Customize the look and feel of the payment page to maintain brand consistency.

Confirmation Page

After payment, users are redirected back to your website’s confirmation page.

SDK Integration (Mobile Apps)

Integrate SDK

If you have a mobile app, integrate the payment gateway’s SDK into your app’s code.

User Experience

Ensure a seamless user experience within your app, providing a smooth payment process.

Test Transactions

Before going live, conduct thorough testing of the payment gateway integration. Most payment gateway providers offer a sandbox environment for testing transactions without actual money being involved.

Compliance and Security

Ensure that your integration complies with industry standards and regulations. Moreover, the developers should implement security features to protect customer data and transactions.

Go Live

Once testing is successful, switch your website to live mode. Update any necessary configurations, such as switching API endpoints from the test environment to the production environment.

Monitor and Maintain

Regularly monitor transactions, address any issues promptly, and stay informed about updates from both your eCommerce platform and the payment gateway provider.

Provide Support

Be prepared to offer support to customers who may encounter issues during the payment process. Ensure that your customer support team is familiar with common payment-related queries.

Integrate Payment Gateways With MMC Global

Let’s ease the integration of robust payment gateways with the help of professionals. Our developers help you build your solution and integrate payment gateways flawlessly. We also provide tech support if any inconvenience occurs and fix it in real-time to deliver a better user experience.

[Nasir-hu-mein heading=”Instant Payment Gateway Experience” para=” Connect with the perfect payment gateway UAE to ensure secure and instant payments for your customers and elevate your shopping experience around the clock.”]Conclusion

Selecting the right payment gateway for your eCommerce venture in the UAE is a strategic decision that can impact the success of your business. By considering factors such as security, integration capabilities, supported payment methods, transaction fees, and customer support, you can make an informed choice that aligns with your business goals.

Moreover, integrating a payment gateway into your eCommerce website requires careful planning, attention to security, and a clear understanding of your chosen payment gateway’s integration methods. Following the steps outlined above and collaborating with experienced developers can help ensure a smooth and secure integration process, ultimately providing your customers with a seamless and reliable online shopping experience.

Whether you opt for Telr, PayFort, CCAvenue, Verifone, or Checkout.com, prioritizing the needs of your customers and the efficiency of your transactions will contribute to the growth and sustainability of your eCommerce business in the thriving market of the UAE.