Fintech App Development in 2022: Top Trends Need Your Attention

Fintech mobile app development and web apps boost all financial institutions concerning technology. People like to interact with mobile apps, with an exceptionally intuitive UI that delivers a better user experience. In financial institutions, applications make a great space. It helps the user to make quick money transfers, bill payments, transaction history, and much more. In fact, there are many Fintech App that you can see below:

Moreover, a positive change in financial institutions is to adopt technology at its best. Technology is not leaving any industry to leverage its potential and get the most out of it. It empowers the sector by giving accessibility, saving time, maximizing operations, minimizing operational costs, boosting productivity, etc.

Although financial institutions spread their reach from local to international, technology still puts efforts to streamline further operations. In fact, the term “fintech” says how efficiently technology and finance collaborate to build a robust infrastructure to ease users.

Finance is always a critical hot bite as it deals with the money of others. A massive to tiny element matters a lot. Such as user information, account details, account passcode, online data, banking database, etc.

This article will disclose the latest fintech mobile app development trend that makes it more reliable and trustworthy. Before moving forward to trends, I would like to talk about FINTECH and the importance of its existence.

The global financial sector is expected to be worth US$26.5 trillion in 2022, with a CAGR of 6%.

Fintech App Development = Finance + Technology

Fintech or financial technology refers to the collaboration of finance and technology to provide outperformed solutions that assist financial departments. By adding technology to finance, everyone observed a robust change in financial institution performance. Fintech is not a company or any organization, but it refers to the inclusion of technology in a financial organization. All the technology used to streamline financial work is under the umbrella term FINTECH.

FinTech is one of the world’s fastest-growing businesses. It eases the financial services and financial management of all financial institutions using technology to provide more ease and security.

60% of credit unions and 49% of banks in the U.S. believe that fintech partnership is essential.

In addition, technology can bind multiple applications into one complete ERP solution. By integrating various functionalities, you don’t need to revise regular tasks repeatedly. Sending confirmation messages, notification alerts, users’ payment receiving, other transaction details are all at your fingertips.

What are Fintech Apps?

Fintech applications (also known as financial technology apps) are widely used nowadays because they have altered the way firms operate. Because of this industry, electronic transactions have become considerably more convenient for individuals. Fintech firms arose in response to the need for a more efficient financial system.

At MMCGBL, we are specialized in providing Fintech apps with the utmost functionalities and features. Fintech app development is not an easy task but it requires a high level of tech knowledge. And we are proud to share that our developers have the skills to complete every project with ease.

If you work in finance and believe that your company’s operations can improve, FinTech software is an excellent investment. Let’s look at Fintech app trends for 2022 for your Fintech app development.

Fintech App Development Trends For 2022

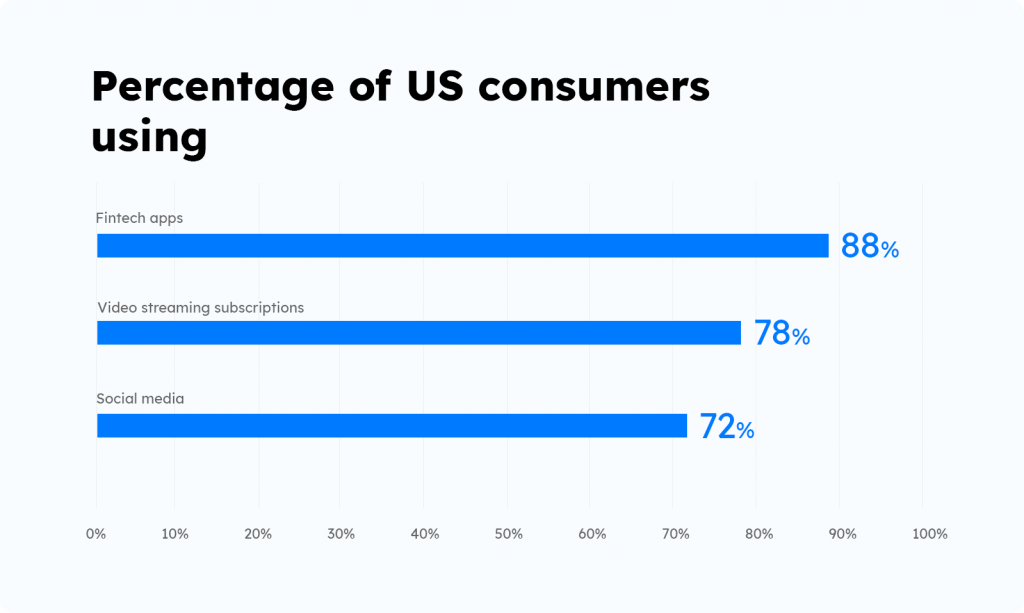

96% of global consumers are aware of at least one fintech service or company. The reach of the fintech market is exclusively growing, and it is an undeniable fact that the ongoing development makes this happen. By implementing fintech app solutions, the industry reduces the gap between clients, employees, and suppliers. The latest trend in Fintech app development can optimize further hurdles regarding security, digital, and accessibility.

Blockchain App Development

A blockchain is a digitally distributed, decentralized, public ledger that exists across a network. Blockchain is the emerging technology with the most advanced functionalities that makes the system error-free and secure. Blockchain technology rules over the fintech industry because the spending on blockchain solutions will reach $11.7 billion globally.

- High marketing advantage with current financial systems

- Faster and cheaper transactions locally and internationally

- Growing and optimizing the cryptocurrency market

- Boost the popularity of ICOs (initial coin offerings)

Another survey says that Financial companies can save up to $12 billion a year using blockchain. Blockchain-based cryptos might produce up to $1 billion in income for the banking sector alone.

In fintech app development, blockchain helps to integrate secure payment gateways, manage clearance and settlements, Identity management and protection, and smart contracts.

Deployment of blockchain technology is challenging with regulatory limitations and a lack of application cases. Most businesses are still unfamiliar with blockchain technology. However, it may be challenging to use, especially since rules in most countries are unknown. Blockchain-based FinTech firms, on the other hand, are on the increase, and the most popular fintech apps contain blockchain transactions.

Artificial Intelligence For Fintech App

Many banking applications provide customized financial advice to assist users in reaching their financial goals. It manages their income and spending and does a variety of other things. Artificial intelligence boosts the personalization component in the fintech app, so users promptly engage in getting help. Even the AI chatbot in fintech app development helps the user assist 24/7 and respond to users in real-time without skipping one.

- Reduces cost and saves time

- Automated conversational support

- Marketing research and set predictions

- Fraud detection by blocking user’s request

- Improve security and user experience

AI-powered FinTech developments are mainly responsible for this personalization. Bank of America, for example, has an app that helps customers plan their costs using AI and a customized approach for each customer. Furthermore, the institution uses AI to anticipate default likelihood for businesses that need loan management.

FinTech businesses are now able to create complicated financial market models based on real-time data to give better service to clients. Artificial intelligence aids in the making of smarter financial decisions and the reduction of customer service expenses.

Biometric Authentication In Fintech App Development

As the fintech app is sensitive in terms of privacy, biometric authentication is one of the best trends to ensure security. Financial assets are now secure in various ways, thanks to mobile technology. In fact, one of the most reliable techniques for identifying a person and avoiding identity theft is biometric authentication. Although no one security mechanism can guarantee 100 percent security, voice, face, and fingerprint recognition are trustworthy.

- A reliable method for verification

- Preventing fraud, theft, and any mishap

- Enable Face recognition and fingerprint

- Lower risk, higher security

Biometric identification is also handy since it eliminates the need for users to fill in passwords every time they open an app. Low friction is critical for a pleasant user experience in mobile products.

With biometric authentication, two-factor authentication is also helpful to verify the transaction. It also helps to be safe from any inconvenience, mistake, or fraud. The biometric authentication trend is used tremendously, and if you are thinking of building your app, don’t forget to ask your developer to embed this technology.

AI Chatbot Banking Leverage Fintech App

A chatbot is one of the best inventions to reduce workload, improve productivity, boost user experience, save time, provide 24/7 customer support, etc. Chatbot banking is becoming a must-have option in mobile application development. Fintech apps also encourage its existence because it helps their client retain for the long run.

It can simply add to an official banking website, social media platform, or even for more personalization, WhatsApp chatbot at its best. It also unburdens the human agents because the AI banking chatbot gives a human-like touch while assisting without skipping one.

Chatbot helps entertain daily queries, get customer feedback, real-time leads generation, ticket generation, etc. It is helpful if you train it well. There are many platforms where you can build your chatbot with zero coding skills. You can also hire a professional to help you develop and manage your chatbot platform for personal fintech app development.

Easy Payment Innovations

Contactless payments, mobile payments, smart speaker systems, mobile wallets, AI and machine learning for security, and identity verification technologies are all examples of payment advancements in FinTech. In addition, Fintech app development can enhance its credibility by supporting accessible payment innovation.

- It allows clients to make large transactions securely.

- Multiple payments option can be quicker and more convenient than accepting checks

- You don’t have to be concerned about faulty checks or counterfeit money.

- In some cases, mobile payments may be more dependable than card-based purchases.

- Allows overseas visitors to make purchases more comfortably.

The transfer of money for any reason is rising the spike as fintech introduces multiple mediums such as debit cards, credit cards, online banking, etc. May lead customers to make more frequent or more significant purchases.

Fintech Autonomous Finance Trend

Autonomous finance employs artificial intelligence (AI) and automation to provide tailored, optimum financial services experiences. It necessitates a transformation in how businesses approach operations and the digitization of what was formerly analog and on paper. What is the significance of this now? What does this mean for clients of financial services?

- Autonomous finance needs less manual effort from customers

- Algorithm-driven approach save customers money by understanding their needs

- Autonomous finance unlocks proactive support

- The built-in AI can understand customers, individually and collectively,

FinTech’s advantages pave the way for future developments such as autonomous finance. It is based on the idea of self-driving finances. Not only does technology aid customers in making instant decisions about their money. It also does all of these things, such as how to authorize a loan at a lower interest rate, where to invest the money, or what to do with an overdrawn account.

Robo-advisors, who dealt with software-based financial planning and mutual fund management, were the forerunners of autonomous finance, then moved to automotive-saving applications and, lastly, credit card debt management solutions.

Bottom Line

The financial services business is expanding at a fast pace. The aforementioned FinTech developments have emerged in response to client expectations. They aid providers in providing additional financial services, such as improved financial data availability, fast processing execution, increased transparency, better customer lifecycle assistance, and more effective identity verification.

The FinTech revolution is intensifying. If you don’t want to be left behind, acquire your clients’ confidence by listening to them, creating a seamless and transparent experience. Moreover, researching Fintech industry trends, respecting your clients’ privacy, and always making tech investments that fit the newest tech advancements with people’s wants.