Fintech App Development – 9 Stages For Robust Fintech Applications

Online transaction is now standard, whether to pay a small utility bill or make a huge transaction with vendors. Online payment is just a few taps away with the online banking system. Financial technology or the fintech industry makes it possible via fintech mobile app development and other resources. The popularity of fintech app development is a breakthrough, I must say!

People are curious about their wealth, but technology builds trust and gives them a safe and secure method to make payments. Initially, people were not ready to give single details about their account number, and they used the traditional way of depositing and withdrawing money by cheques.

We are witnessing the most digitized era where communication is made easy, networking is accessible, and transactions worldwide are not a big deal. It can’t help with technology; even the most critical game changer is advanced technology based on complex algorithms.

Businesses are the puppet of technology as they run on-site and remotely operations, maintain their transactions with customers and vendors, record a large amount of data and insights, and much more.

Businesses and consumers feel complete with online shopping, remote working, and user-friendly communication tools, and one of the most important things is making payments around the globe.

These all activities are taking on a single point, that is, technology. The technology works so well in making financial institutions by providing fintech websites and fintech app development. You can see the rise of cryptocurrency on a large scale and the fastest-growing eCommerce industry that makes shopping easiest by providing multiple payment methods.

Let’s see what fintech is and what its future is.

What is Fintech or Financial Technology?

Technology and financial services are combined in fintech. Fintech, to put it simply, uses technology to provide financial services attainable to everyone.

It’s all about automating and improving the provision of financial services utilizing cutting-edge technologies like AI, ML, and blockchain.

The ease, security, and scalability of mobile devices for banking, lending, trading, and other financial services have made the fintech business appealing to consumers.

The need to innovate has increased as more companies enter the digital payments market, giving rise to fresh fintech concepts.

Read more: 8 Fintech Mobile App Ideas to Become a Next Unicorn

How will fintech affect and influence payments in the future?

Fintech app development is without a doubt changing the way that financial services are provided. Businesses in this area have begun anticipating novel approaches that could influence the future direction of banking and finance.

So, the following is how these advancements are influencing the finance sector:

- Products and services in the fintech industry are growing in popularity across industries and enterprises. The goods and services are no longer limited to the banking industry alone due to a high acceptance rate.

- There is no longer a contactless payment method. They are now the most popular payment option.

- Businesses are discovering new methods to offer customer assistance as fintech rediscovers the value of consumer pleasure. Customer satisfaction is the most crucial of everything, from safe payments to 24 hours of access.

- Mobile phone availability and easy access to technology have transformed banking into a virtual consumer experience.

- As a digital asset, cryptocurrency is becoming more widely accepted, and the finance industry is evolving to offer proper support.

Step-by-Step Guide For Fintech App Development

It may not be easy to build cutting-edge financial software that stands out from the crowd, but if you approach the task correctly, you may come up with a beautiful solution. You can create a fintech app using the step-by-step instructions we’ve provided.

Let’s look at it.

Step#1: Determine Their Niche

You must first clearly determine the ideal niche for your financial app before moving on with development. Spend some time learning about:

- What does the kind of software you want to create do?

- Which fintech subfield do you wish to concentrate on?

- Choose if it is a mobile banking app, a global money transfer app, a trading app, a crowdfunding app, or something else.

- Next, ascertain who your target market is and what needs they have.

- You select the precise market for your financial application.

- Does your target audience come from a specific location or demographic?

- Do you want to introduce your fintech app locally before expanding it internationally?

- Have you had experience in this field?

The remainder of your app development process will go more smoothly if you’ve established clear expectations at this stage.

Step#2: Deal With Compliance

Make sure you are informed of your legal options in this area before committing to the functionality of your app.

Your intended fintech app development solution needs to be legitimate legally.

This is because each nation has its own laws that must be followed. To monitor for non-compliance, several countries use different financial safeguarding mechanisms.

The most well-known examples of such rules are digital signature certificates, PCI DSS (Payment Card Industry Data Security Standard), AML (Anti Money Laundering), and KYC (Know Your Customer). All fintech apps must follow the strict requirements of such regulations.

Additionally, if you are creating a fintech app solution for clients in Europe, it must comply with GDPR or the General Data Protection Regulation.

You risk getting in trouble if you don’t comply with rules and standards governing data security, anti-fraud legislation, and many other areas.

Therefore, be sure to follow this step strictly.

Step#3: Explore your edge

You’ve now reached the point where you can determine what may provide your fintech app with an advantage over your rivals.

Utilize detailed market research to do this by:

- assessing and examining your rivals

- examining their app’s benefits and drawbacks,

- discussing any potential issues with the fintech applications created by others, and

- develop the app concept to offer a superior solution and give you an edge over rivals.

For instance, there are many different types of financial services. Still, you may add an app to enhance the current quality, making it quick and simple compared to other applications.

Step#4: List Down The Must Have Features

It’s time to decide which fintech features are a must-have when you’ve finished your market research and determined the aim of your fintech app development.

Remember that your software doesn’t need to be overloaded with functionality. Instead, consider integrating features that will make your application more creative, quick, economical, safe, and user-friendly to produce a robust fintech solution.

List all the features that are absolutely necessary for the app to work, in addition to the features that are anticipated of any fintech app development, such as cross-platform compatibility, two-factor authentication, OTP-based log-in, and chatbot for round-the-clock customer service.

Step#5: Hire The Right Team or Company

The proper fusion of fintech’s two key components—finance and technology—will enable you to create the desired outcome.

You may develop a distinctive financial app with a skilled team of professionals like Imagination.

Hire a group of knowledgeable developers or collaborate with a reputable app development company like MMCGBL with the necessary experience.

Hiring MMCGBL gives you special perks such as a collaborative team, budget-friendly development cost, highly qualified team members for your assistance, exceptional designers, and much more. We have big different industry projects that you can visit, including fintech apps. In short, we are here to get your back, and you will surely get what you want.

Step#6: Go For The Accurate Tech Stack

Choosing the appropriate tech stack is crucial when creating a financial application. With so many alternatives available, there is a danger that you will choose the wrong one. And it could have detrimental effects.

Depending on its functionalities and features, you’d require separate technical tools for the back-end and front-end of the app.

Because every app project differs, you cannot anticipate a one-size-fits-all stack for your online and mobile financial solutions. It would be best if you got the right advice from the developers with vast knowledge about the technology bundle for fintech app development.

Therefore, a wise choice of technology stack may assist you in lowering development costs, reducing software development time, and accelerating the app’s time to market (TTM). Not to mention, effective technology utilization will guarantee the app’s success once released.

Keep an eye on what’s going on in the market. The ideal development partner will guide you in selecting the best tech stack and demonstrate why it should be utilized in your project.

Step#7: Expected Budget & Evaluate Cost

Budget restrictions in the final phases of program development may cause unneeded delays.

The expense of your fintech app development solution depends on many elements, including the app’s functionality, legal compliances, maintenance costs, testing, security, and newer technology like blockchain.

It works best when you make an estimate before the app development process begins. To create a development plan for your project, start by creating a scope document with a budget and deadlines.

Step#8: Start Build MVP

It’s a good idea to test your app concept before launching your full-fledged financial solution. This is accomplished through an MVP, or minimal viable product, version of the software.

I’ll simply explain what an MVP is now. Your software has just enough functionality to check out is evidence of its idea. It is your fintech app’s most basic version.

Do not initially undervalue the value of developing an MVP; it is a fantastic method to showcase your new application and draw in investors. Additionally, you will receive early feedback on your app, lowering the likelihood that your concept won’t be successful later.

This phase is crucial for expanding the potential for the advancement of your software and minimizing any risks.

Step#9: Continuous Updates

Unlike the phases stated above, this is a continuous process that continues into the future.

After the app is out, the development process for your fintech app development shouldn’t end. Instead, once you start receiving user input, keep updating and enhancing it.

By periodically embracing new technology and trends, operations and products should be upgraded and improved.

Additional help is essential. It is a win-win situation with rapid reaction and betterment in customers’ problem resolution.

Real-Life Example of Fintech App Development

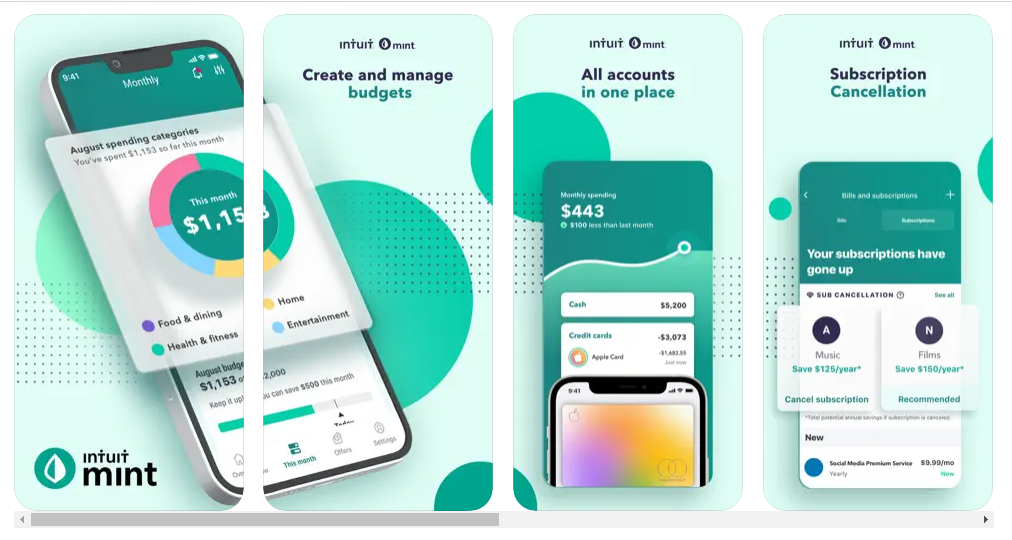

Mint

When gathering pertinent information like accounts, user cards, and transactions, the Mint app, which is popular and one of the successful FinTech app development, popular in the USA, is a great resource. You may use the app to track your transactions and spending, pay your bills, and even make a budget that you can stick to.

Users receive notice messages that remind them of their unpaid debts and recommendations based on past spending habits. The data transmitted with Mint is protected with 128-bit SSL, and all data is encrypted with 256-bit encryption.

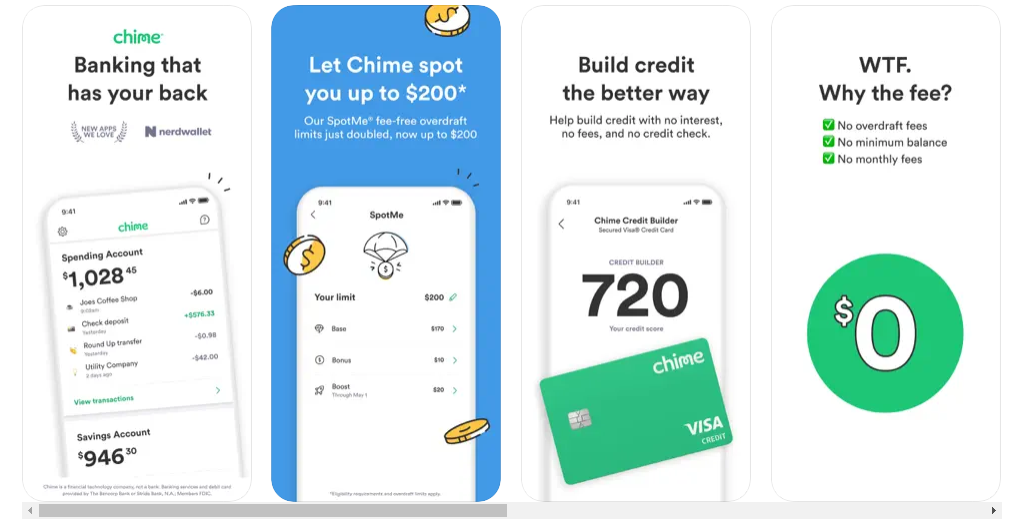

Chime

One financial application rapidly expanding in the USA as a mobile-only bank is the Chime app. Users may control their consumption and savings accounts without being charged any additional fees.

It offers customers a selection of automated saving options, making it one of the most excellent budgeting programs. Chime is one of the country’s most practical FinTech banking applications, thanks to its extensive free ATM networking.

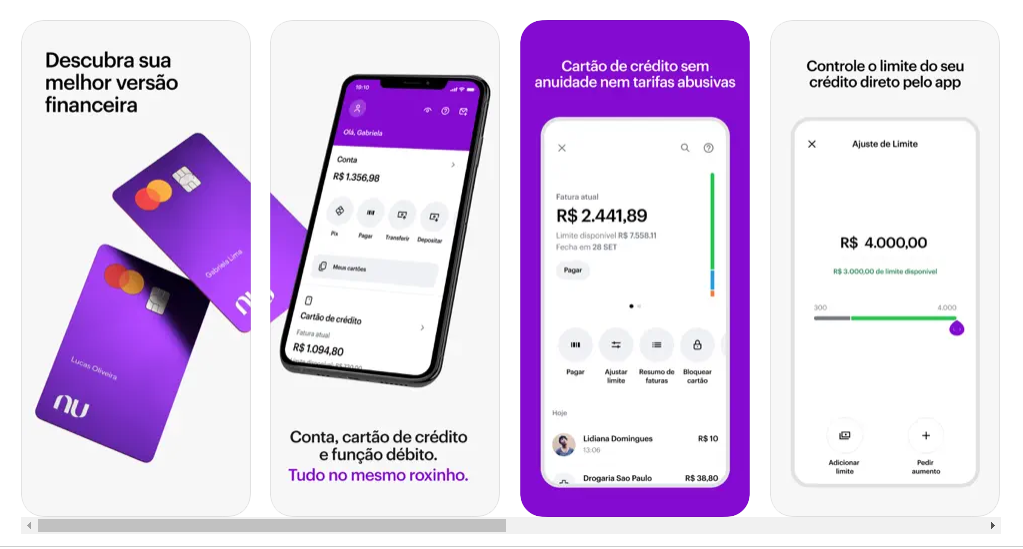

Nubank

A top FinTech software and one of the leading FinTech industry, Nubank is an online banking tool with Brazilian roots. By enabling rapid money transfers, offering access to bills, tracking expenditure by category, and erasing purchases using Nubank reward points gained, it has grown to become one of the top FinTech applications.

With a home market of 12 million subscribers, Nubank is regarded as the sixth-largest financial institution. The top features include savings at users’ disposal, Cards with no annual fee being accepted anywhere, and a Rewarding point program.

Read More: Fintech App Development in 2022: Top Trends Need Your Attention

Bottom Line

All industries, such as financial institutions, have a high weightage of technology. You can experience payment gateways on simple online stores or check out the bitcoin app to explore cryptocurrency.

The fintech app development expands its arena and gives you financial management tools, online banking, insurance app, loan apps, and much more in the fintech field. People are earning money through fintech app development. It can happen if you have the right team to help you build mobile applications in every industry.

At MMCGBL, you can find professional teams with voluminous experience in the tech field. If you are interested and request a consultation, we are ready to share our thoughts on your project.

FAQs Related to Fintech App Development

The inclusion of technology in financial institutions in web or mobile application development is called fintech app development. The app may be a banking, insurance, or expenditure monitoring app.

Yes, the rise in fintech apps is proof of the increasing demand of users. Here is why it is so,

- A broad spectrum of development capabilities

- Large-scale customer base

- Futuristic and advanced technology stack

- Easy to integrate into the corporate sector

- Increasing the revenue streams

- The fastest-growing adoption.

It depends. The more you add the functionality and features, the more it takes time. However, it also can rely on the developer’s expertise. At MMCGBL, we first finalize the requirements and then start our project development cycle with good team collaboration and coordination, so ultimately, we can deliver projects on time.