Generative AI In Finance: A Next-Gen Breakthrough In Digital Financial Sector

The upsurging innovation in the financial industry brings unwavering influence to the world. Digital financial solutions turn the traditional workflows of managing and transitioning money across the border. But the real excitement lies in the realm of technology, where the economic and banking sectors are pushing beyond the boundaries of imagination with the infusion of Generative AI in finance operational workflows, a transformative power that is revolutionizing the way we do finance.

Gaining credibility in the financial industry is quite difficult. Moreover, it requires a 100% secure environment to protect people’s valuables, errorless workflows, safe repositories, as well as quick access to the exchange of money. With the help of digitalization, most financial organizations have achieved their goals of providing next-gen banking and financial experience.

However, emerging AI technology like Generative AI is not just a buzzword, but a game-changer. It offers advanced functionalities that streamline financial workflows, improve decision-making, and boost ROIs. The contemporary approach to including AI in finance is not just a trend, but a strategic move that thrives in multidisciplinary opportunities, including automating tasks, error-less data analysis and reporting, behavior analysis, fraud detection, and other financial attributes.

By incorporating Generative AI into financial operations, businesses can harness its unique benefits. Generative AI in finance not only enhances accuracy and eliminates human errors but also safeguards valuable assets. As the usage of Generative AI continues to rise, with a projected market growth of 28.1% from 2022 onwards, it is further expected to exceed $9.48 billion by 2032.

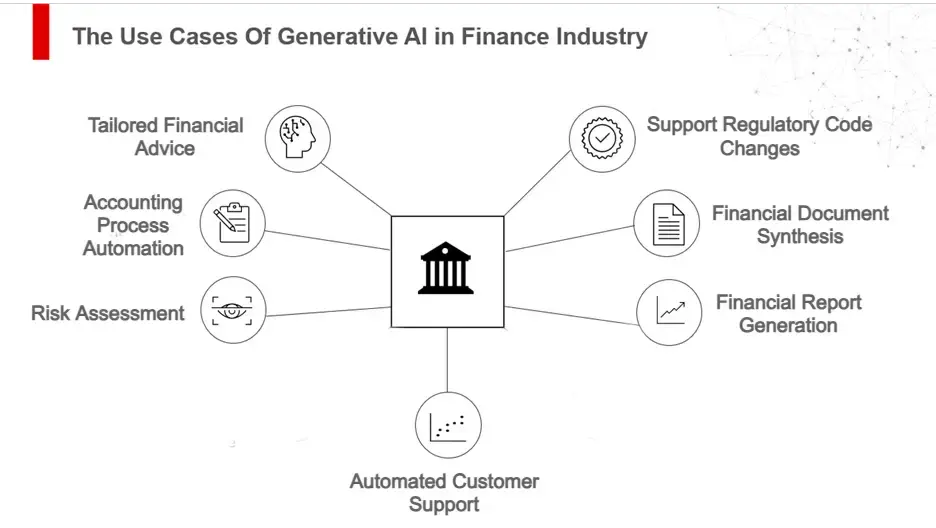

The Use Of Generative AI in Finance

First and foremost, the use of generative AI is not just about improving the decision-making process and transforming routine operations with the maximum level of efficiency. It’s about enhancing employees’ productivity, ultimately impacting financial business growth. In fact, businesses can observe not just growth, but substantial revenue growth by delivering exceptional experiences across multiple focal and diffuse channels, a promising future that Generative AI can help unlock.

If you are a beginner in Generative AI, here is a brief description of what Generative AI is.

Generative AI, a subfield of Artificial Intelligence, is a powerful tool for building apps or software that can generate diverse types of content. In fact, it can create image, video, textual, and graphical content by interpreting human commands in the form of ‘prompts.’

Generative AI is capable of understanding human language and providing output in response to queries, making it a versatile and valuable tool in various industries, including finance.

Moreover, Generative AI has a broad scope in providing recommendations by analyzing user behavior patterns, fraud detection, customer service automation, risk management, and much more.

Let’s explore the use cases of Generative AI in finance and banking without further ado.

Support Regulatory Code Changes

Generative AI can analyze many datasets of regulatory and compliant policies. Manually, adopting the regulatory code change is hard, which causes typical risks in the processing environment. As a result of implementing Generative AI, you can generate efficient regulatory code changes that mitigate the risk of regulations.

Tailored Financial Advice

Generative AI can provide personal assistance by providing advice based on a deep study of user financial insights. With the help of advanced algorithms, Generative AI can suggest different saving plans, open up multiple investment opportunities, etc. Moreover, a financial guide throughout the journey of saving and investment is a good addition to making informed decisions.

Financial Document Synthesis

Generative AI simplifies searches in a vast dataset of information. Moreover, the automatic extraction of required data from diverse sources saves the time and effort of financial analysts. It is also viable with the utmost efficiency and no human errors. Generative AI algorithms have the extreme power to search and synthesize financial data documents to proceed with actionable results.

Accounting Process Automation

Generative AI has automated multiple manual tasks, including the accounting process. GenAI is the source of minimizing efforts in these tedious tasks. Furthermore, it provides better efficiency in the accounting management process, from automated data entry and reconciliation to categorization.

Financial Report Generation

No more hectic for generating financial reports and analysis because Generative AI is here to simplify this task efficiently. By monitoring data flows, graphical representations, descriptive elaborations, and suggestions for improving areas, Generative AI is capable of doing all related tasks in one go.

Read More: AI in Finance – A phenomenal Change In Fintech Industry

Automated Customer Support

With the help of a Generative AI-based chatbot solution, you can provide real-time, 24/7 assistance to entertain your customers. In financial services, companies set up a vast pool of customer care agents to resolve customer issues. It takes a lot of time to hire and a huge cost of their salaries. Replacing the human agents with the automated chatbot cuts the cost in half. Moreover, it delivers round-the-clock availability by just training your bot according to relevant datasets. Most chatbots are self-trained by understanding functioning patterns and user behavior; it is a highly dominant and emerging Generative AI tool in the financial industry.

Financial Risk Assessment

Generative AI can detect situations, assess risk, and provide information for real-time action plans. With the vast data source, financial statements, and other financial indicators, Generative AI algorithms can evaluate the financial credit risk of individual borrowers or businesses. Moreover, it allows lenders to make accurate decisions regarding interest rates, loan approvals, and credit limits.

Wrapping Up

Generative AI is an emerging AI technology for almost every industry, including finance, healthcare, education, retail, eCommerce, etc. Every business that wants to thrive in this innovative market must possess AI-enabled solutions to extract data, automate tedious tasks, analyze and report, and much more. In fact, your investment in AI will be worthwhile and ensure more lucrative opportunities.

MMC Global should be your first choice if you want to connect with a trusted AI development company to build your AI-based solution. We are a top-notch AI-based software development company with a great portfolio of simple to complex project development. Our commitment to excellence reflects the utmost efficiency and client satisfaction. Connect with us to learn more about us.