In the fast-evolving landscape of technology, one innovation has emerged as a disruptive force with the potential to redefine the way we engage in transactions, secure information, and establish trust – blockchain. Originating as the underlying technology for cryptocurrencies like Bitcoin, blockchain in financial services has transcended its roots to become a versatile solution with applications spanning finance, healthcare, supply chain, and beyond.

At its core, blockchain in financial services offers a decentralized and transparent ledger system. It leverages smart contracts and cryptographic principles to revolutionize the traditional paradigms of data management and transactional processes. In this era of interconnected global economies, the implications of blockchain in finance are profound. However, it increases efficiency, security, and accessibility across industries.

In this exploration, we delve into the intricacies of blockchain technology, unraveling its impact on finance, digital identity, fraud detection, corporate decision-making, and service accessibility.

Moreover, as we navigate the complexities and potentials of blockchain in finance, it becomes clear that we stand at the precipice of a transformative era. In fact, decentralized, trustless systems have the power to reshape the very foundations of how we conduct business and secure our digital interactions.

What Is Blockchain Technology?

Blockchain technology is a decentralized and distributed ledger system allowing multiple parties to record and store information securely, transparently, and tamper-resistant. It gained prominence as the underlying technology for cryptocurrencies like Bitcoin, but its applications extend far beyond digital currencies. In the context of financial services, blockchain technology has the potential to revolutionize various aspects of the industry.

Read more: How is Blockchain App Development Helping The Business Industry?

Here’s a detailed overview of blockchain technology in the context of finance:

Basic Components of Blockchain Technology

Blocks

Information is grouped into blocks, each containing a list of transactions or data. Moreover, blocks are linked together in a chronological chain using cryptographic hashes.

Decentralization

Unlike traditional centralized databases, blockchain is decentralized. Multiple nodes (computers) maintain the network and validate transactions.

Consensus Mechanism

Nodes in the network reach an agreement on the validity of transactions through a consensus mechanism. Common mechanisms include Proof of Work (used by Bitcoin) and Proof of Stake.

Cryptography

Cryptographic techniques secure the data and provide privacy and integrity. The usage of public and private keys for secure transactions helps a lot.

Key Features of Blockchain Technology

Immutability

It is nearly impossible to alter once a block is added to the chain. This ensures the integrity and permanence of recorded transactions.

Transparency

The entire transaction history is visible to all participants in the network. This transparency reduces fraud and enhances trust among participants.

Security

The decentralized nature and cryptographic principles make blockchain resistant to hacking. To compromise the system, a malicious actor must control most of the network, which is highly improbable in well-established blockchains.

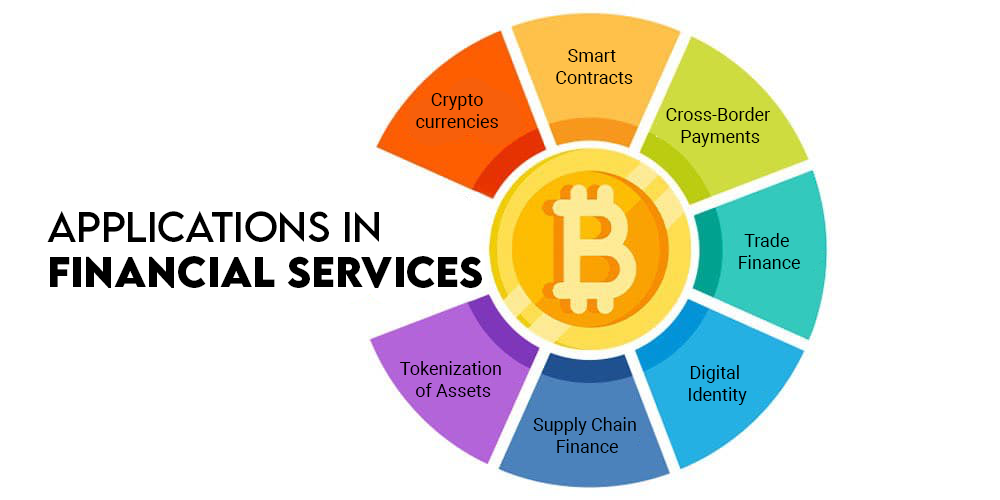

Applications in Financial Services

Cryptocurrencies

The most well-known application is the underlying technology for cryptocurrencies like Bitcoin and Ethereum. Blockchain in financial services enables secure and transparent peer-to-peer transactions without the need for intermediaries.

Smart Contracts

Self-executing contracts with the terms directly written into code. Smart contracts automate and enforce the execution of contractual agreements, reducing the need for intermediaries and minimizing the risk of fraud.

Cross-Border Payments

Blockchain in financial services facilitates faster and more cost-effective cross-border transactions by eliminating intermediaries and reducing settlement times.

Trade Finance

Blockchain can streamline and automate the complex processes involved in trade finance, reducing paperwork, improving transparency, and minimizing the risk of errors.

Digital Identity

Blockchain helps secure and verifiable digital identities, reducing identity theft risk and improving the efficiency of identity verification processes in financial services.

Supply Chain Finance

Blockchain enhances transparency and traceability in supply chains, reducing fraud, ensuring the authenticity of products, and optimizing financing options.

Tokenization of Assets

Real-world assets like real estate, art, and commodities can be represented as digital tokens on a blockchain. It is for fractional ownership and easier transfer of ownership.

Challenges and Considerations

- As the number of transactions increases, scalability becomes a challenge for some blockchain networks.

- Regulatory frameworks for blockchain and cryptocurrencies are still evolving, and compliance with existing regulations can be complex.

- Ensuring compatibility and interoperability between different blockchain networks is crucial for widespread adoption.

- Proof-of-work consensus mechanisms, as used in Bitcoin, can be energy-intensive. Some blockchains are exploring more energy-efficient alternatives like Proof of Stake.

Use Cases Of Blockchain Technology In Financial Services

Blockchain for Business Process Automation

Blockchain technology holds immense potential for business process automation, offering a transformative solution to streamline and enhance various operational aspects across industries. At its core, blockchain provides a decentralized and distributed ledger that allows for transparent, secure, and tamper-resistant recording of transactions and data.

In the realm of business process automation, smart contracts play a pivotal role by enabling self-executing agreements based on predefined rules. These contracts automate and enforce the terms of a given business process. In addition, it reduces the need for intermediaries and minimizes the risk of errors or disputes. Through blockchain-based automation, businesses can achieve greater operational efficiency as processes become more transparent, auditable, and immune to unauthorized alterations.

This technology is particularly beneficial in scenarios where multiple parties are involved, and trust is a critical factor. Industries such as supply chain management, procurement, and finance can leverage blockchain to automate complex workflows, ensuring real-time updates, reducing delays, and enhancing overall reliability.

Moreover, blockchain’s decentralized nature fosters collaboration among stakeholders, enabling them to share a common, immutable record of transactions. As businesses increasingly recognize the potential of blockchain for automation, its adoption is likely to usher in a new era of efficiency, transparency, and trust in various organizational processes.

Blockchain for Financial Services Documentations

Blockchain technology offers significant advantages in the realm of financial document management by providing a secure, transparent, and efficient solution for handling sensitive financial information. In traditional financial systems, document management often involves multiple parties, intermediaries, and manual processes, leading to delays, errors, and increased vulnerability to fraud. Blockchain, with its decentralized and tamper-resistant ledger, addresses these challenges.

Smart contracts, a key feature of blockchain, can be utilized to automate various stages of financial document workflows. These self-executing contracts enable the automatic execution of predefined actions when specific conditions are met. It reduces the need for manual intervention and minimizes the risk of human error. This automation enhances the speed and accuracy of document processing, improving overall efficiency.

Moreover, blockchain technology can enable the secure and efficient sharing of financial documents among authorized parties, reducing the reliance on traditional paper-based documentation and manual verification processes. This can lead to cost savings, faster decision-making, and improved collaboration in financial transactions.

Blockchain For International Interbank Settlement

Blockchain technology holds significant promise for cross-border interbank settlement, revolutionizing the traditional processes in financial services. In the context of cross-border transactions, where multiple intermediaries, differing time zones, and diverse regulatory frameworks often lead to delays and inefficiencies, blockchain offers a streamlined and secure solution.

By utilizing a decentralized and transparent ledger, blockchain ensures real-time updates and visibility for all participating banks, reducing the settlement time considerably. Smart contracts, a key feature of blockchain, can automate the execution of contractual agreements, eliminating manual processes and reducing the risk of errors. Moreover, the immutability of the blockchain ledger enhances the security and integrity of transactions, providing a tamper-resistant record of all interbank settlements.

Additionally, the use of blockchain technology can significantly lower transaction costs by removing the need for multiple intermediaries and reconciliations. As a result, blockchain for cross-border interbank settlement has the potential to enhance the speed, security, and cost-effectiveness of international financial transactions, ultimately fostering greater trust and collaboration among global financial institutions.

Blockchain for fraud detection

Blockchain technology offers a robust framework for enhancing fraud detection and prevention in various industries. The decentralized and immutable nature of the blockchain ledger makes it well-suited for creating a secure and transparent system that is resistant to fraud.

Blockchain enables real-time monitoring of transactions, allowing for quick detection of suspicious activities. Any unusual patterns or deviations from established norms can trigger alerts, facilitating prompt investigation and mitigation of potential fraud.

Blockchain for Complex decision-making

Blockchain technology has the potential to revolutionize corporate decision-making by introducing transparency, accountability, and efficiency into the process. Through the use of decentralized ledgers, blockchain ensures that all authorized stakeholders have access to a single version of the truth. In fact, it reduces the risk of misinformation and enhances trust.

Smart contracts, inherent to the blockchain, can automate and enforce predefined rules, facilitating the execution of agreements without the need for intermediaries. This streamlines decision-making processes and minimizes the risk of human error. Additionally, the immutable nature of the blockchain ledger ensures that the historical record of decisions remains tamper-resistant, providing a transparent and auditable trail. By leveraging blockchain, corporate decision-makers can enhance collaboration, reduce inefficiencies, and foster a more secure and accountable decision-making environment.

Read more: 9 Growing List of Industry Using Blockchain

Wrapping Up

In conclusion, blockchain technology represents a transformative force with far-reaching implications across various industries. Its decentralized and transparent nature, coupled with features like smart contracts and cryptographic security, has the potential to revolutionize the way we conduct transactions, manage data, and establish trust in a digital environment. In financial services, blockchain offers solutions for cross-border transactions, smart contracts, and supply chain finance. As a result, it increases efficiency, transparency, and security.

Moreover, the application of blockchain in digital identity verification and fraud detection addresses critical issues in privacy and security. For businesses, the technology provides opportunities for automation, streamlining processes, and fostering more secure decision-making. Whether in finance, healthcare, supply chain, or beyond, blockchain’s impact extends to creating a more accessible, efficient, and trustworthy digital landscape.

However, challenges such as scalability, regulatory frameworks, and industry-wide adoption need to be addressed to unlock the full potential of blockchain technology. As research and development continue, it is evident that blockchain will continue to shape the future of how we interact, transact, and secure information in the digital age.