In parallel with innovation and technological advancement, the banking industry is being transformed with the utmost infusion of digitalization. Everything is a game-changer in the banking industry, from online payment to QR codes and encrypted online accounts to decentralized ledger technology.

Gone are those days when transferring money globally takes 4-5 business days; the instant money transfer streamlines many business operations. However, the smart banking experience is not only inventive but also a cornerstone of a strong economy. It promotes modern banking standards regarding efficiency, customer engagement, and security.

The digital banking experience eliminates the long-waited paperwork, waiting queues, and one-size-fits-all approach for all banking customers. As far as digitalization exists, it spikes up customer expectations with personalization.

The banking industry faced skepticism and discredits over digitalization. People did not trust online transactions and faced traps and security risks for their wealth. To overcome these challenges in implementing a digital banking experience, many entrusted tools help the banking industry transform. In fact, the digital banking industry is expected to project Net Interest Income worldwide, which is set to reach US$822.5bn in 2024.

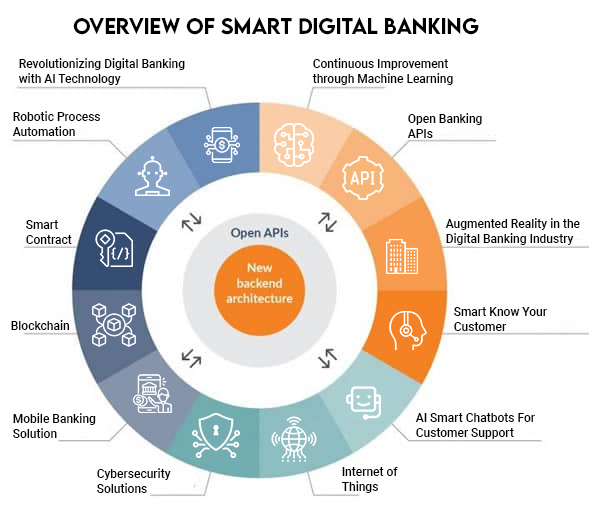

Overview of Smart Digital Banking

Smart digital banking encompasses a range of technologies and tools to revolutionize how financial services are delivered and consumed. These technologies are reshaping the banking landscape from artificial intelligence and blockchain to biometric authentication and big data analytics. It offers customers personalized experiences, enhanced security, and greater convenience.

Revolutionizing Digital Banking with AI Technology

Artificial intelligence (AI) emerges as a game-changer, reshaping how customers interact with financial institutions and enhancing their banking experience. One of the key benefits of integrating AI into digital banking is the ability to provide highly personalized experiences to customers. By analyzing vast amounts of data, AI algorithms can gain insights into individual preferences, behaviors, and financial needs. Moreover, banks can offer tailored product recommendations, personalized financial advice, and targeted promotions.

Digital banks can anticipate future financial trends and behaviors with AI-driven predictive analytics. As a result, it empowers customers to make informed decisions about their finances. AI algorithms can provide personalized recommendations for budgeting, saving, and investment strategies by analyzing spending patterns, income fluctuations, and market trends. This proactive approach helps customers achieve their financial goals and strengthens their trust in the bank’s expertise and reliability.

Continuous Improvement through Machine Learning

Machine learning algorithms enable digital banks to continuously improve their services based on customer feedback and evolving market dynamics. AI models can identify patterns and trends by analyzing user interactions and transaction data. Furthermore, it allows banks to refine their algorithms, optimize processes, and develop innovative solutions to meet changing customer needs. This iterative approach fosters agility and innovation, positioning digital banks for long-term success in a competitive market.

Augmented Reality in the Digital Banking Industry

Augmented reality (AR) is poised to revolutionize the digital banking experience by offering immersive and interactive solutions that bridge the gap between the physical and digital worlds. With AR technology, customers can visualize their financial data in real-time through their smartphones or AR-enabled devices. Moreover, it delivers deeper insights into their transactions, account balances, and investment portfolios.

For instance, AR apps can superimpose financial information onto the user’s surroundings. It allows them to see their budget breakdowns projected onto their living room walls or visualize potential investment returns while browsing a virtual marketplace. Moreover, AR-powered banking apps can enhance the in-branch experience by providing virtual tours of bank branches. It guides customers to specific services or ATMs and offers personalized financial advice through virtual advisors. By leveraging the immersive capabilities of AR, digital banks can create engaging and intuitive experiences that empower customers’ experience. Also, customer can easily manage their finances more effectively and make informed decisions in real-time.

Smart Know Your Customer

Smart Know Your Customer (KYC) solutions are revolutionizing the digital banking industry by leveraging advanced technologies such as AI & ML to streamline onboarding. These innovative solutions utilize biometric authentication, document verification, and behavioral analytics to verify the identity of customers quickly and accurately. It also reduces the time and effort required for account opening while ensuring compliance with regulatory requirements.

By automating the KYC process, digital banks can enhance efficiency, minimize manual errors, and mitigate the risk of fraudulent activities. Ultimately, it improves the overall customer experience in the banking industry. Additionally, smart KYC solutions enable banks to stay ahead of evolving compliance standards and adapt to changing regulatory landscapes seamlessly. With the increasing demand for digital banking services, implementing smart KYC solutions is crucial for building trust. KYC fosters customer loyalty and drives sustainable growth in the digital banking industry.

Blockchain & Smart Contracts

Blockchain technology and smart contracts are poised to revolutionize the digital banking industry by introducing unprecedented security, transparency, and efficiency levels. Utilizing decentralized ledgers, blockchain enables secure and tamper-proof recording of financial transactions. Moreover, it ultimately reduces the risk of fraud and enhances trust between parties. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, automate and enforce the execution of transactions without intermediaries.

Blockchain and smart contracts can streamline various processes in the digital banking industry. It may include cross-border payments, trade finance, and loan disbursements, reducing processing times and costs while ensuring accuracy. Moreover, blockchain-based solutions offer enhanced data privacy and protection, giving customers greater control over their financial information. As digital banks increasingly adopt blockchain technology and smart contracts, they can unlock new opportunities for innovation, improve operational efficiency, and deliver more secure and seamless banking experiences to their customers.

AI Smart Chatbots for Customer Support

Chatbots and virtual assistants have become integral components of the digital banking landscape. It offers personalized and efficient customer service around the clock. These AI-powered solutions leverage natural language processing and machine learning algorithms to understand and respond to customer inquiries in real-time. It also provides instant support and guidance across various channels.

Chatbots deployed on banking websites, mobile apps, and messaging platforms can assist customers with account inquiries, transaction histories, and general banking information. In fact, it enhances accessibility and convenience. Virtual assistants also take the customer experience further by offering advanced functionalities. It can be financial planning advice, product recommendations, and even executing transactions on behalf of the user. By leveraging chatbots and virtual assistants, digital banks can improve customer engagement, reduce wait times, and free up human resources to focus on more complex tasks. In fact, it drives greater satisfaction and loyalty among their customer base.

Cybersecurity Solutions

Cybersecurity solutions safeguard the digital banking industry against evolving threats and vulnerabilities. Protecting sensitive customer data and financial assets is paramount with the rise of online transactions and the proliferation of digital channels. Advanced cybersecurity measures include robust encryption protocols, multi-factor authentication, and intrusion detection systems. Moreover, it helps prevent unauthorized access to banking systems and networks, mitigating the risk of data breaches and fraud.

Additionally, proactive threat intelligence and real-time monitoring enable banks to identify and respond swiftly to security incidents. It minimizes potential damage and disruption to operations. Continuous security assessments and penetration testing ensure systems remain resilient against emerging threats and comply with regulatory standards. By prioritizing cybersecurity investments and adopting a holistic approach to risk management, digital banks can instill trust and confidence among customers. It fosters long-term relationships and sustains their competitive edge in the ever-changing landscape of online banking.

Open Banking APIs

Open banking APIs (Application Programming Interfaces) are revolutionizing the digital banking industry by fostering collaboration, innovation, and enhanced customer experiences. These APIs enable secure and standardized communication between financial institutions, third-party developers, and fintech companies. Moreover, with open API, the system allows them to access and share financial data and services in real-time. By leveraging open banking APIs, digital banks can offer their customers a wide range of innovative solutions and personalized services.

Third-party developers can build new applications and services that integrate seamlessly with banking systems. It provides customers with greater choice and flexibility in managing their finances. Moreover, open banking APIs promote competition and drive innovation in the financial services industry. It facilitates product improvements, lower costs, and better consumer outcomes. As open banking initiatives continue to gain traction worldwide, digital banks that embrace APIs as a core part of their strategy can unlock new opportunities for growth, differentiation, and value creation.

Mobile Banking Solution

Mobile banking has become an indispensable aspect of the modern banking experience. It offers customers unparalleled convenience, accessibility, and flexibility in managing their finances on the go. Moreover, with the widespread adoption of smartphones and mobile devices, digital banks are leveraging mobile banking apps to provide their customers with a comprehensive suite of services and functionalities. From checking account balances and transaction history to transferring funds, paying bills, and depositing checks remotely, mobile banking apps empower users to perform a wide range of banking tasks anytime, anywhere, with just a few taps on their mobile devices.

Moreover, mobile banking apps often feature advanced security measures, such as biometric authentication and encryption. It ensures the safety and confidentiality of sensitive financial information. As technology continues to evolve, mobile banking apps are also changing, integrating innovative features. It may include mobile wallets, peer-to-peer payments, as well as personalized financial insights powered by artificial intelligence. In today’s fast-paced world, mobile banking has become more than just a convenience—it’s an essential tool for managing finances efficiently and staying connected to the digital economy.

Get more info: How a Mobile App Development Company in Los Angeles can Transform your Banking App

Internet of Things

The Internet of Things (IoT) is poised to transform the digital banking industry by connecting everyday objects to the Internet, enabling them to collect, exchange, and analyze data in real-time. In digital banking, IoT devices can range from wearables like smartwatches and fitness trackers to home appliances, vehicles, and even personal finance management tools. By integrating IoT technology into banking systems, financial institutions can offer innovative services and experiences to their customers.

For example, IoT-enabled wearables can provide real-time notifications about account activity, spending patterns, and financial goals. It empowers users to make informed decisions about their finances on the go. Smart home devices like thermostats, security cameras, and appliances can also be integrated with banking apps to automate bill payments, monitor energy usage, and manage household budgets more efficiently.

Furthermore, IoT data offer personalized recommendations, targeted promotions, and predictive insights, enhancing customer engagement and loyalty. As the IoT ecosystem evolves, digital banks embracing IoT technology stand to gain a competitive edge by delivering seamless and intelligent banking experiences to their customers.

Get more info: IoT Devices in Banking and Finance

Wrapping Up

The transformation of the banking industry into a smart digital banking experience represents a pivotal shift towards innovation, efficiency, and customer-centricity.

From AI-powered chatbots and virtual assistants to blockchain-based smart contracts and IoT-enabled devices, these technologies are revolutionizing every aspect of the banking journey, from account opening and transactions to financial planning and customer service.

Moreover, integrating these technologies fosters greater accessibility, convenience, and flexibility. The unparalleled innovation empowers customers to manage their finances anytime, anywhere, with confidence.

Digital banks continue to embrace innovation and adapt to changing consumer preferences and market dynamics. They are well-positioned to lead the industry toward a future of smart, connected, and transformative banking experiences.