In progressive business opportunities, everyone wants a rapid and accurate set of operations that leads to successful business growth. In the fast-evolving landscape of asset management, staying ahead of the curve is not just a preference but a necessity. As organizations grapple with vast data, integrating cutting-edge technologies becomes pivotal. In this context, Artificial Intelligence (AI) Generative Technology emerges as a game-changer, ushering in a new era of efficiency and precision in decision-making processes within asset management solutions.

Asset Management With AI

Asset management with AI refers to integrating artificial intelligence (AI) technologies and techniques in asset management, which involves overseeing a client’s investments and portfolios to achieve specific financial objectives. However, AI plays a crucial role in automating and enhancing various aspects of asset management. Machine learning algorithms can analyze vast amounts of financial data, identify patterns, as well as predict market trends.

AI-driven tools can optimize portfolio allocation, risk management, and asset selection by processing real-time market information and adjusting strategies accordingly. Additionally, natural language processing (NLP) capabilities in AI allow for extracting valuable insights from textual data, such as financial news and reports, influencing investment decisions. The use of AI in asset management aims to improve efficiency, reduce human bias, and enhance overall performance in the management of financial assets.

How Does Generative AI Work in Finance?

Generative AI is employed in the finance department to enhance decision-making processes by leveraging its ability to generate realistic and data-driven scenarios. This technology can simulate market conditions, analyze historical data, and project potential outcomes. As a result, it enables financial professionals to make more informed and accurate decisions.

Generative AI models, such as generative adversarial networks (GANs) or recurrent neural networks (RNNs), can generate synthetic financial data, stress test portfolios, and predict market trends. By utilizing these advanced capabilities, financial institutions can gain valuable insights, optimize investment strategies, and mitigate risks, ultimately improving the overall effectiveness of decision-making in the dynamic and complex landscape of the finance sector.

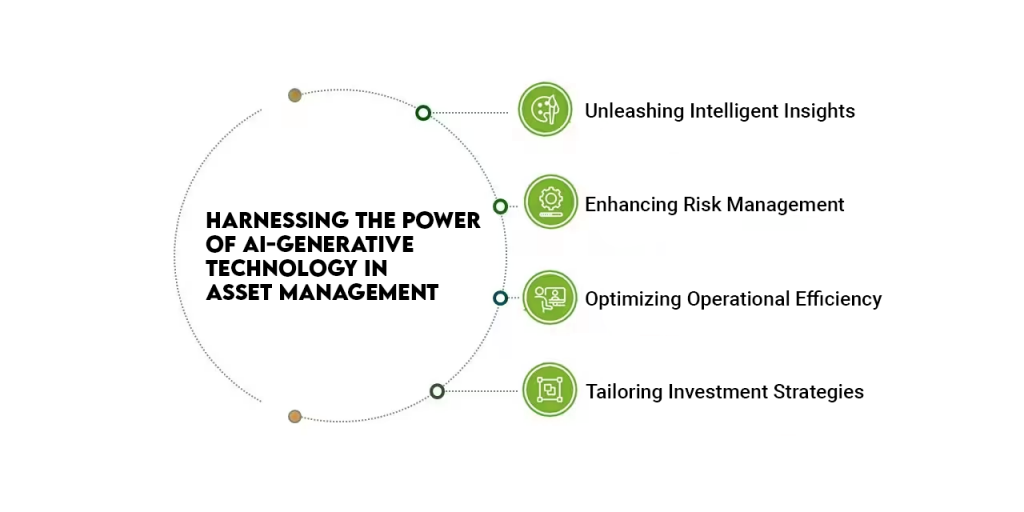

Harnessing the Power of AI-Generative Technology In Asset Management

Unleashing Intelligent Insights

Asset management involves navigating through a myriad of data points, from market trends and financial reports to operational metrics. AI Generative Technology, powered by advanced algorithms, sifts through this data deluge, providing real-time insights that are both comprehensive and actionable. Moreover, it enhances the analytical capabilities of asset managers, enabling them to make informed decisions swiftly.

Moreover, AI Generative Technology excels in recognizing patterns and trends that may elude traditional analysis methods. This proactive approach allows asset managers to anticipate market shifts and make strategic decisions ahead of the curve.

Enhancing Risk Management

One of the paramount concerns in asset management is risk mitigation. AI Generative Technology is pivotal in this arena by offering sophisticated risk assessment models. Additionally, it constantly evaluates market conditions, regulatory changes, and global events, providing a dynamic risk landscape that adapts in real time.

By leveraging AI-generated insights, asset managers can identify potential risks early on, allowing for timely adjustments to investment portfolios. In fact, this safeguards assets and ensures a proactive response to emerging challenges, bolstering the resilience of investment strategies.

Optimizing Operational Efficiency

In the realm of asset management, time is of the essence. AI Generative Technology significantly streamlines decision-making processes by automating routine tasks and data analysis. Furthermore, it enables asset managers to focus on strategic initiatives rather than getting bogged down by repetitive, time-consuming activities.

Through AI-driven automation, asset management solutions can achieve unprecedented levels of efficiency, freeing up valuable human resources for more complex decision-making tasks. This accelerates the decision-making cycle and enhances the overall agility of asset management operations.

Tailoring Investment Strategies

AI Generative Technology excels in personalizing investment strategies based on individual client preferences and risk appetites. However, this does not replace the role of asset managers; instead, it augments their capabilities by providing personalized insights and recommendations. Human expertise combines with AI precision, creating a synergy that delivers tailored investment solutions for clients.

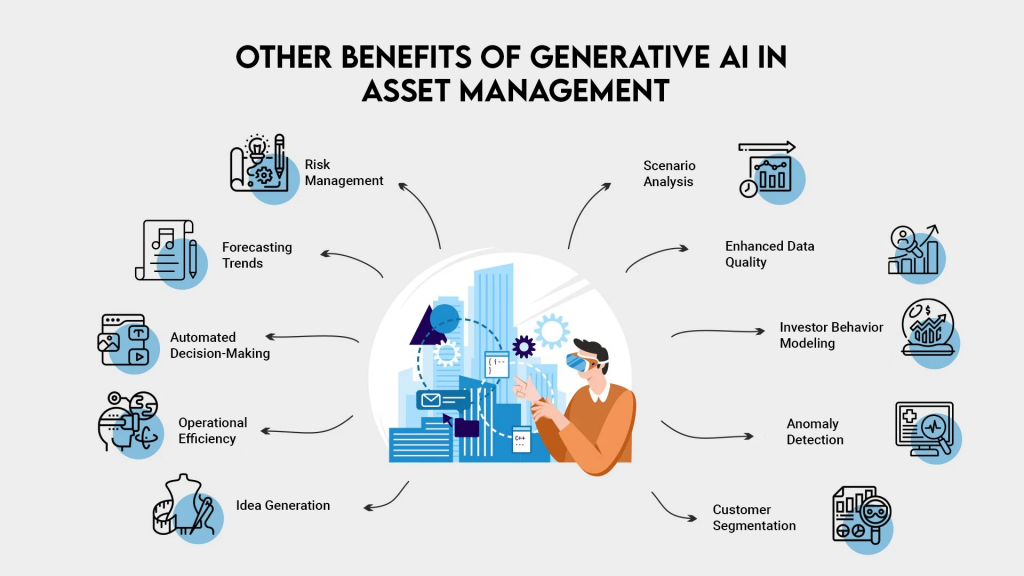

Other benefits of generative AI in asset management

Generative AI, which includes technologies like Generative Adversarial Networks (GANs) and other generative models, can offer several benefits in the field of asset management. Here are some of the key advantages:

Risk Management

Generative AI can analyze historical data and simulate various market scenarios to help asset managers understand and manage risks better. However, this enables the optimization of portfolios to achieve a balance between risk and return.

Forecasting Trends

Generative models can analyze large datasets and identify patterns and trends in financial markets. This information can be used to make more informed investment decisions by predicting future market movements.

Automated Decision-Making

Generative AI can be used to develop algorithms for automated trading. These algorithms can execute trades at high speeds. Automated trading takes advantage of market opportunities in real time based on predefined criteria.

Anomaly Detection

Generative models can detect unusual patterns or anomalies in financial transactions, helping to identify potential fraud or suspicious activities. This enhances the security and integrity of asset management processes.

Customer Segmentation

Generative AI can analyze customer data to identify different segments and preferences. Asset managers can tailor investment strategies to individual client needs, providing a more personalized and effective service.

Enhanced Data Quality

Generative AI can be used for data augmentation, creating synthetic data to supplement existing datasets. This can be especially valuable in situations where real data is limited, improving the robustness and accuracy of models.

Investor Behavior Modeling

Generative AI can analyze historical investor behavior, allowing asset managers to understand how different market conditions affect investor decisions. This understanding can inform strategy adjustments and client communication.

Scenario Analysis

Generative models can simulate different economic and market scenarios. It helps asset managers make more informed decisions by understanding the potential impact of various factors on their portfolios.

Idea Generation

Generative AI can assist in generating new investment ideas by analyzing vast amounts of data and identifying novel patterns that human analysts might overlook.

Operational Efficiency

Automation through generative AI can lead to cost savings by streamlining routine tasks, reducing the need for manual intervention, and improving overall operational efficiency.

The Future of Asset Management

In conclusion, integrating AI Generative Technology in asset management solutions reshapes the industry’s landscape. It brings forth a future where decisions are not just data-driven but intelligently generated, where risks are managed and proactively anticipated. The synergy between human expertise and AI capabilities creates a paradigm shift, creating a more responsive, efficient, and client-centric asset management ecosystem.

As organizations embrace this transformative technology, the journey toward improved decision-making in asset management takes a quantum leap. It actually propels the industry into a future defined by innovation, agility, as well as sustained success.